Since 2020, cryptocurrency has seen a huge surge in popularity, and has completely turned the financial industry upside down. Studies have shown that an increasing number of people are losing faith in traditional investment authorities, and looking for something a bit more independent. For those people, the discovery of Bitcoin (and cryptocurrency in general) has served as a godsend. Polls reveal that an increasing number of American adults are becoming interested in crypto trading, and the same is true for people from all over the globe. A good chunk of millennial millionaires claims that a quarter of their wealth is placed in digital assets, most notably Bitcoin, or sometimes non-fungible tokens. Usually, both. So, it would seem that crypto is here to stay, and experts are certain that it is only going to rise in popularity from here on out.

What is Cryptocurrency?

While it has been around for a decade, the popularity of cryptocurrency is a rather new phenomenon, so many might not be aware of what crypto is. For those who aren’t aware of cryptocurrency, in this section, we are going to explain what it is, and how it works.

Cryptocurrency is a digital currency, which exists on a blockchain, and uses encryption (hence the name). Often times, the most popular cryptocurrencies are decentralized, meaning they are not beholden to any central authorities, like banks and governments. What this means is that, unlike FIAT currencies, cryptos are not subjected to the banking fees and taxations, or at least fees are not as steep as they would be for FIAT currency.

The most notable way that people make a profit from cryptocurrency, is by investing, and then re-selling their assets, and when it comes to crypto trading, a rather popular form of trading is day trading. So, what is day trading, and what are the best platforms to engage in it?

What is Day Trading?

Within the world of investments, trading, and finances, one of the most popular forms of trading is day trading. So, what is day trading, can it be done using crypto, and what are the best platforms through which you can day trade in crypto?

In the eyes of many investors, day trading is one of the easiest ways to make money off of crypto. The basic concept of day trading is buying and selling a stock (in this case in a cryptocurrency) in the same day. In this way, traders exploit the volatility of the crypto market, and in doing so manage to get a profit. For those interested to try their hands in day trading, let us take a look at some of the best day trading platform on the current market.

Best Crypto Day Trading Platforms

The following are best day trading crypto platforms, all of which offer different pros and cons when it comes to crypto trading. So, let us discuss the merits that each of them brings to the table.

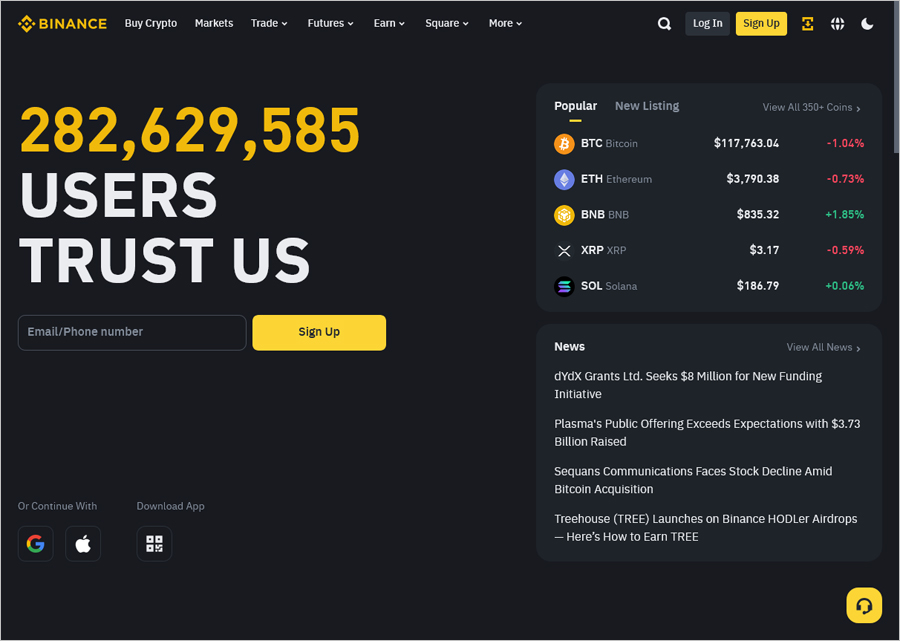

Binance [ Create account ]

Binance is the world’s largest crypto exchange by trading volume, offering a vast ecosystem that goes far beyond basic spot trading. Users can access futures with high leverage, margin trading, staking, launchpads for new token projects, liquidity farming, and even an NFT marketplace. The platform lists hundreds of coins and trading pairs, with some of the lowest fees in the industry, especially when using its native BNB token for discounts.

While Binance leads in functionality and reach, it has faced regulatory scrutiny in multiple countries. Binance.com is not available to US residents, who are instead directed to Binance.US, a separate entity with fewer features and listings. Despite this, Binance continues to innovate and expand, attracting both retail traders and institutions. It’s ideal for power users who want everything in one place – but it requires a good understanding of the tools offered to fully take advantage of the platform.

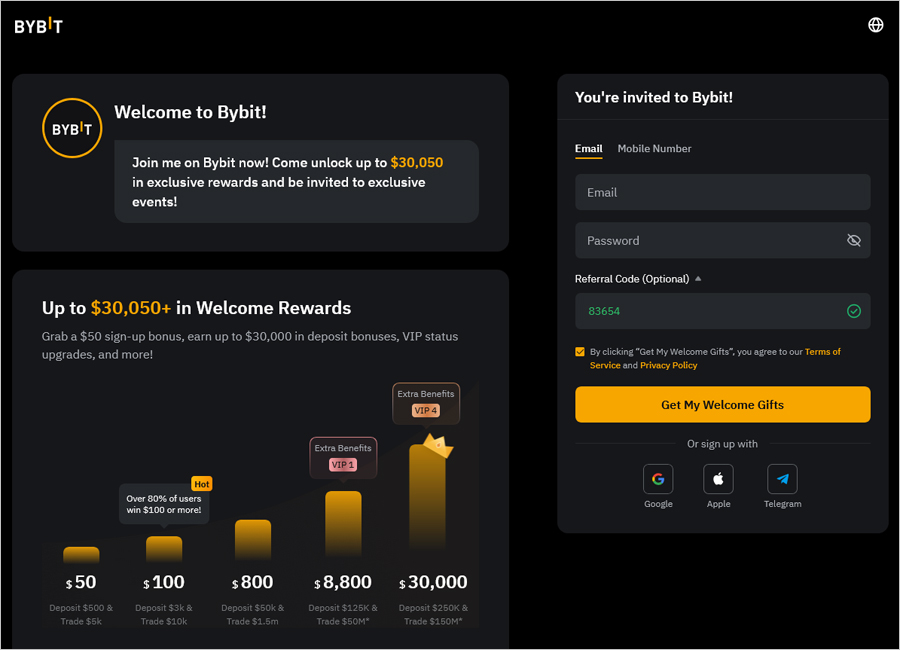

Bybit [ Create account ]

Bybit began as a derivatives-focused platform and quickly gained traction among professional traders for its fast execution and high liquidity in perpetual futures. Since then, it has expanded to include spot trading, staking, copy trading, launchpools, and more. The user interface is sleek and modern, optimized for both desktop and mobile, and the platform is known for hosting aggressive trading competitions and reward campaigns.

In recent years, Bybit has introduced KYC requirements and made efforts to expand its global regulatory footprint. It offers up to 100x leverage on certain contracts, which appeals to experienced traders but also comes with high risk. Educational content is provided through the Bybit Learn portal, though the platform still leans more toward seasoned users than beginners. For those who thrive in a fast-paced, high-reward environment, Bybit delivers a versatile and energetic trading experience.

OKX [ Create account ]

OKX is a global exchange with a strong presence in Asia and growing influence in Europe and Latin America. It offers a full-featured trading suite that includes spot, margin, futures, options, DeFi integration, and an NFT marketplace. OKX also runs a popular Earn section with fixed and flexible savings, dual investment, and staking options, making it attractive not only for traders but also for passive income seekers. The platform supports hundreds of cryptocurrencies and trading pairs, with competitive fees and high liquidity across major markets.

Security-wise, OKX maintains cold storage of assets and offers multi-factor authentication, withdrawal whitelisting, and anti-phishing codes. In 2023, it launched a self-custody wallet and increased focus on Web3 services. The interface is polished and user-friendly, especially on mobile. OKX continues to expand its regulatory licenses and has made transparency a priority through proof-of-reserves reports. It strikes a good balance between advanced tools for pro traders and ease of use for retail investors.

BingX

BingX is a fast-growing exchange that blends social trading, derivatives, and spot markets. One of its standout features is copy trading, which allows users to automatically replicate the trades of successful professionals. This lowers the barrier for newcomers who lack technical skills but still want market exposure. The platform supports spot, perpetual, and grid trading, and regularly offers zero-fee promotions to attract new users.

Though relatively new compared to older players, BingX has quickly gained a loyal user base thanks to its simple interface and active community. It supports multiple languages, operates globally with licenses in various regions, and has introduced staking and crypto savings features. For casual traders and beginners who value simplicity and community-driven features, BingX offers an engaging alternative to more complex exchanges.

MEXC [ Create account ]

MEXC positions itself as a high-liquidity exchange with a broad selection of altcoins and fast listing of new tokens. It’s often one of the first platforms to offer trading for newly launched crypto assets, which makes it a popular spot for early adopters and high-risk traders. MEXC offers spot, futures, margin, staking, and launchpad features, along with regular promotions and token buyback programs to boost ecosystem engagement.

The platform provides a mobile app and web interface with moderate complexity – not as minimal as Coinbase, but not overwhelming either. KYC is optional for basic features but required for higher limits. MEXC is not licensed in all jurisdictions but continues to expand its legal framework. It’s a go-to platform for altcoin hunters and those who enjoy a faster-paced, speculative trading environment.

HTX

HTX, previously known as Huobi, is a veteran exchange with deep roots in the Asian crypto market. After exiting mainland China due to regulatory pressure, it rebranded and restructured its operations under a global framework, now officially headquartered in the Seychelles. The platform supports spot and futures trading, staking, crypto loans, and a wide selection of altcoins. Its sleek interface, multilingual support, and robust mobile app make it accessible to both new users and experienced traders.

Following the rebrand to HTX, the exchange has been actively working to restore user trust by improving transparency and compliance standards. It has implemented proof-of-reserves reporting and is pursuing licenses in multiple jurisdictions. Despite past setbacks, HTX maintains high liquidity on core trading pairs and remains especially strong in the Asian market. For traders seeking a broad selection of tokens, deep liquidity, and a platform actively modernizing its reputation, HTX is still in the game.

eToro

eToro stands out by merging traditional investing with crypto trading on a single social platform. It allows users to trade not only cryptocurrencies but also stocks, ETFs, and commodities, all within one account. What really sets eToro apart is its copy trading feature – users can follow and automatically mimic the strategies of successful investors. It’s fully regulated in the EU, UK, US, and Australia, and focuses on ease of use and investor protection.

For crypto traders, eToro offers a limited but curated set of coins, with custody handled internally. You can’t withdraw crypto to external wallets unless you use their separate eToro Wallet app, which may be a drawback for users who prefer self-custody. Fees are embedded in the spread, making them less transparent. Still, for investors who want a clean, regulated, and all-in-one solution with a strong social aspect, eToro is hard to beat.

Skilling

Skilling is a Scandinavian fintech company that offers CFD trading on a wide range of assets including crypto, forex, indices, and stocks. It’s designed for users who want to speculate on price movements without owning the underlying asset. The platform supports over 50 cryptocurrencies and offers leverage, stop-loss tools, and technical indicators suited for short-term traders. The onboarding process is quick, with KYC integrated early and a demo mode for practice.

Unlike traditional crypto exchanges, Skilling doesn’t offer wallets or token transfers – it’s all about contracts. It’s regulated in Cyprus and the UK, which gives it a layer of credibility, especially for European users. With integrations like TradingView and cTrader, the platform is geared toward those who prefer a more traditional brokerage-style experience with a crypto edge. If you’re looking for flexibility, regulation, and advanced tools in a CFD format, Skilling delivers.

Margex

Margex is a niche platform focused entirely on crypto derivatives, offering up to 100x leverage on a curated list of trading pairs like BTC, ETH, XRP, and others. It stands out for its clean interface and strict anti-manipulation system, which aggregates liquidity from multiple providers to prevent price wicks and unfair liquidations. Registration is fast, with no KYC required for basic usage, which appeals to users valuing privacy.

While the coin selection is limited, Margex makes up for it with fast execution, responsive support, and strong security features like cold storage and 2FA. It’s best suited for traders who already understand leveraged products and want a lightweight, focused environment. The platform avoids distractions like staking or NFTs and keeps the experience purely trading-centric. For users seeking simplicity, speed, and leverage – Margex is a sharp, purpose-built tool.

Whether you are new to a complicated and volatile crypto market or not, you won’t take a long time to get a grasp of the platform. With its easy-to-navigate interface, you can quickly open new buy and sell orders, access the transparent reporting system, and keep a finger on an ever-changing crypto market to make prudent trading decisions. To begin trading, you will need to complete a brief registration without providing your personal information. The multi-collateral wallet allows you to experiment with different trading pairs without owning the chosen assets. Deposit any crypto like Bitcoin, Ethereum, Litecoin, Ripple, Solano, and others and trade different pairs at the same time. Margex applies no commission; therefore, you cover only reasonable trade and funding fees.