Many crypto investors reasonably ask themselves – where is the safest place to store cryptocurrency? And rightly so. Keeping funds on exchanges involves significant risks. Regardless of claimed protections or regulatory status, accounts on centralized crypto exchanges can be hacked, frozen, or suddenly shut down for any number of reasons. Asset holders who don’t control their private keys are entirely dependent on the integrity of third parties. History has shown numerous cases of massive fund losses on exchanges – Mt. Gox and FTX being the most infamous examples.

The only reliable solution for long-term crypto storage remains the hardware wallet. These are physical devices that allow users to control their private keys offline, without any internet connection. This is especially important for those looking to store multiple cryptocurrencies and maintain a large crypto portfolio.

What Is a Multi-Currency Hardware Wallet

Multi-currency hardware wallet is a physical device designed to securely store private keys for cryptocurrencies running on different blockchains. Unlike devices built only for Bitcoin or a limited set of networks, multi-currency wallets support a broad range of assets – from Ethereum and Solana to Polygon, Cosmos, Avalanche, and tokens built on ERC-20, BEP-20, TRC-20, SPL, and many more standards.

Technically, this multi-currency support is made possible through embedded or pluggable libraries that handle various cryptographic algorithms and transaction formats. Most wallets work in tandem with desktop or mobile apps that receive regular updates to support new tokens and blockchain networks. The hardware wallet itself, however, remains an offline device – all transaction signing is done internally, without ever exposing the private keys.

As physical devices, these wallets come with displays, buttons, or touchscreens that allow users to confirm actions manually. This eliminates attack vectors related to interface spoofing. In addition, many multi-currency hardware wallets integrate with dApps, thanks to compatibility with interfaces like WalletConnect, MetaMask, and similar solutions.

Support for a wide range of cryptocurrencies makes these wallets indispensable for investors with diversified portfolios. A single device can securely store Bitcoin, Ethereum, Solana, Binance Coin, DeFi tokens, NFTs, and much more – eliminating the need to leave assets on centralized platforms.

Review of the Best Multi-Currency Hardware Wallets

To select the devices featured in this review, several critical factors were considered – all of them essential for long-term, secure cryptocurrency storage. Specifically:

- Reputation of the manufacturer.

- Level of device autonomy and adherence to the “private keys never leave the device” principle.

- Range of supported blockchains and tokens, including networks like Ethereum, Binance Smart Chain, Solana, Polygon, and more

- Ease of use: screen quality, standalone functionality, mobile support, multilingual interface, and other UX factors.

- Availability of open-source firmware and certified security components.

- Additional features such as backup options, two-factor authentication, DeFi integration, and more.

Below are the best multi-currency hardware wallets for managing a large and diverse crypto portfolio.

Trezor Model T [buy wallet here]

The world’s first hardware wallet was developed by SatoshiLabs, and the Trezor Model T is a direct continuation of their core philosophy – security through openness. Founded in 2013, the company remains a benchmark in the industry. Unlike many competitors, both the firmware and hardware design of the Trezor Model T are fully open-source. This gives users confidence that there are no hidden surprises inside the device.

The Trezor Model T supports over 1,200 cryptocurrencies and tokens, including Bitcoin, Ethereum, Polkadot, Cardano, Litecoin, and all ERC-20 standards. A full-color touchscreen allows users to manage transactions without connecting to a computer – every operation is manually approved, which eliminates social engineering attacks. Integration with Trezor Suite gives full control over your portfolio without the need for third-party apps.

Trezor Safe 3 [buy wallet here]

Built with a certified EAL6+ Secure Element and fully open-source firmware, the Trezor Safe 3 is designed to offer hardware-level security without sacrificing transparency. It protects private keys from physical extraction attempts while giving users full control over how their assets are managed. Unlike many wallets that rely on closed-source components, Safe 3 ensures that every part of the system – from code to cryptographic handling – is independently auditable and trusted by the open-source community.

The device provides seamless access to thousands of cryptocurrencies and tokens through Trezor Suite, supporting all major blockchains including Bitcoin, Ethereum, Solana, and Binance Smart Chain. It also features native support for Shamir Backup (SLIP-39), allowing users to split their recovery phrase into multiple secure shares. Compact and straightforward, Trezor Safe 3 is a strong choice for users focused on core security principles and long-term asset protection.

Trezor Safe 5 [buy wallet here]

Trezor Safe 5 is a high-performance multi-currency wallet built for investors managing large and diverse portfolios. It supports over 9,000 cryptocurrencies and tokens across a wide range of ecosystems, including EVM-compatible chains, Layer 2 networks, and NFT platforms. Whether storing Bitcoin, ERC-20 tokens, DeFi assets, or collectibles, Safe 5 is built to handle complex portfolios with ease.

The device features a large color touchscreen with haptic feedback, Gorilla Glass protection, and advanced backup tools, including Shamir Secret Sharing. Its Secure Element (EAL6+) keeps private keys isolated in tamper-resistant hardware, while the NDA-free architecture aligns with Trezor’s open-source philosophy. For users who demand both broad token support and institutional-grade security, Safe 5 delivers a future-ready hardware wallet experience.

BitBox02 Nova [buy wallet here]

At first glance, the BitBox02 appears modest – minimalist, with no screen or bulky elements. But behind the simplicity lies Swiss precision. Shift Crypto, based in Zurich, has been developing wallets since 2015, guided by principles of auditability, privacy, and independence.

BitBox02 Nova is the updated version, featuring a more powerful chip, enhanced security, and support for Bitcoin, Ethereum, all ERC-20 tokens, and NFTs. A standout feature is the ability to back up the seed phrase to a microSD card – protecting against errors during manual backup and ensuring fast, reliable recovery. All software is open-source, and integration with Electrum and other interfaces takes only seconds.

Ledger Nano X [buy wallet here]

Ledger Nano X is manufactured by Ledger, a well-known French company that’s been in the hardware wallet business since 2014 and has sold over 6 million devices worldwide. This model became a best-seller thanks to its blend of mobility, versatility, and certified security.

Ledger Nano X supports more than 5,500 assets, connects via Bluetooth to iOS and Android, has a built-in battery, and space for over 100 apps. It features a CC EAL5+ certified secure chip – the same level used in banking cards. While its code is closed-source, Ledger is trusted by institutions globally, from crypto funds to exchanges. The wallet integrates with Ledger Live, one of the most user-friendly portfolio management interfaces available.

Tangem Wallet 2 [buy wallet here]

The most unconventional device in this review is the Tangem Wallet 2 – a plastic card with a secure chip, activated via smartphone using NFC. There’s no screen, no battery, no buttons. Everything is managed through the official app. But its strength lies in its architecture – designed from the ground up for security and simplicity.

The card is certified to the EAL6+ standard, used in banking systems. One of its most unique features is that you don’t need to write down a seed phrase – you can issue two or three linked cards that act as synchronized backups. Lose one, and you still have access. Tangem supports over 6,000 cryptocurrencies. It’s a reliable, minimalist wallet with distributed recovery and zero risk of digital leaks – perfect for on-the-go storage or as a secondary wallet.

OneKey Pro [buy wallet here]

In the open-source segment, OneKey Pro stands out for its broad blockchain support and seamless compatibility with Web3 infrastructure. The device features a large touchscreen, built-in battery, Wi-Fi, and Bluetooth – but can also operate entirely offline using QR codes.

It supports over 1,000 cryptocurrencies, including Ethereum, zkSync, Arbitrum, Optimism, Cosmos, Avalanche, BNB Chain, and NFTs on all major platforms. The software is completely open-source. The team collaborates closely with DeFi developers to ensure fast integration. OneKey Pro is ideal for DeFi power users who frequently sign smart contracts and require full compatibility with MetaMask, Rabby, xDEFI, and more.

SafePal S1 Pro [buy wallet here]

If physical isolation is the top priority – SafePal S1 Pro stands alone. It’s the only hardware wallet on this list with no Bluetooth, USB, or other digital connection options – and that’s a strength. SafePal S1 Pro communicates solely through its built-in camera, scanning QR codes to exchange data with the mobile app. This architecture fully eliminates the risk of malware-based attacks via compromised devices.

SafePal S1 Pro was created with backing from Binance Labs, ensuring deep integration with day trading platforms and high liquidity. It supports over 10,000 tokens (!) across more than 30 blockchains, including Bitcoin, Ethereum, Solana, Tron, Polygon, Aptos, and NFTs. Compact, with a color display and built-in battery, SafePal S1 Pro is perfect for those who value maximum isolation, offline autonomy, and ease of use.

Keystone 3 Pro [buy wallet here]

Endorsements from Vitalik Buterin don’t come lightly. Keystone earned high praise for its security architecture. The Keystone 3 Pro is designed with institutional users and advanced hodlers in mind. It operates fully offline, transferring data via QR codes and offering backup options via microSD or manual input.

Keystone 3 Pro features a large display, swappable batteries, and support for multisig wallets. Compatible with Bitcoin, Ethereum, Solana, Cosmos, Aptos, zkRollups, and various Layer 2 networks. Integrates seamlessly with MetaMask, Rabby, Sparrow, and other wallets.

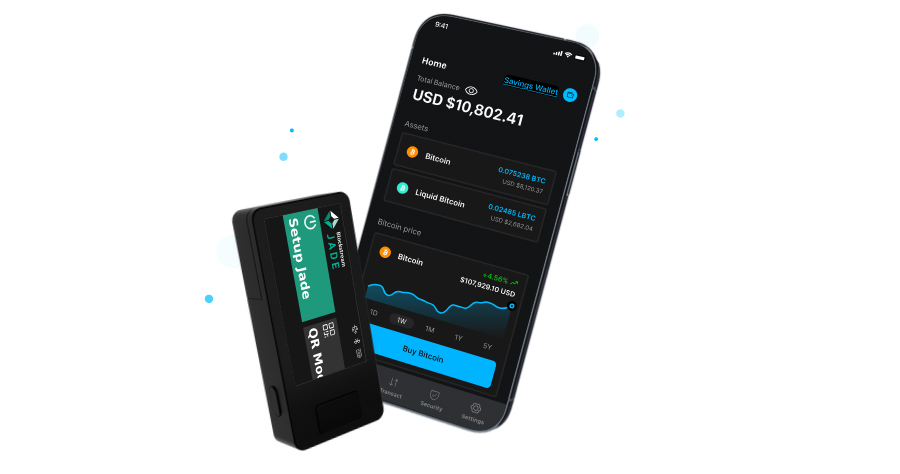

Blockstream Jade [buy wallet here]

To close the list, here’s a hardware wallet I personally recommend. Blockstream Jade doesn’t try to be a one-size-fits-all solution – it’s built specifically for Bitcoin and assets on the Liquid Network. And it does that job exceptionally well. Developed by Blockstream, the company led by Adam Back – a cryptographer who played a key role in creating Proof-of-Work – Jade reflects Bitcoin-first principles in every aspect.

It supports SegWit, Taproot, PSBT, and multisig wallets. Jade integrates with Blockstream Green, connects via USB and Bluetooth, and works with both desktop and mobile. Open-source firmware, robust security, and deep Bitcoin ecosystem integration make it an excellent choice. If your focus is Bitcoin only – this is the hardware wallet I recommend.

How to Ensure the Security of Assets on Hardware Wallets

Even the most reliable hardware wallet cannot guarantee full protection if used incorrectly. Below are key recommendations that are critically important for owners of multi-currency (and regular) hardware wallets:

1. Buy only from the manufacturer or official distributors.

Purchasing from marketplaces (especially second-hand) – carries a risk of receiving a device with compromised firmware or tampered packaging. Many attacks begin at this stage. The wallet should come in a sealed box with security stickers. Its serial number must be verifiable on the manufacturer’s website.

2. Generate the seed phrase only on the device itself.

Genuine hardware wallets generate the seed phrase (BIP39) internally, without any external software. If the phrase comes pre-printed or included in the box – it’s a red flag. The correct process is when the user manually writes down the phrase as it appears on the device screen and confirms it by re-entering it.

3. Store the seed phrase offline, physically.

The seed phrase should never be photographed, screenshotted, or stored digitally. While a paper backup is acceptable, using metal storage plates – fireproof, waterproof, and durable – is strongly recommended (e.g., Cryptosteel, Billfodl, Steelwallet). Keeping the phrase in a bank, home safe, or multiple secure locations is also a good practice.

4. Avoid cloud or digital storage.

Storing your seed phrase in phone notes, Google Drive, Dropbox, or messaging apps is a fast track to losing your funds. These services are often hacked, and one leak is all it takes for someone to gain access to your wallet.

5. Keep firmware up to date.

Hardware wallet manufacturers regularly release security updates. It’s essential to check for new firmware via the official app and update the device manually, following the instructions. If done properly, updating will not affect the stored keys.

6. Enable PIN and optional passphrase protection.

Most wallets support PIN codes to prevent unauthorized access. Advanced users can enable a passphrase – an extra word or sentence that creates a hidden storage area with a separate set of addresses. This adds another layer of security in case of theft or coercion.

7. Use only official applications for integration.

All interactions with DeFi apps, MetaMask, Rabby, and other wallets should go through verified interfaces and require manual confirmation on the device’s screen. Never blindly approve a transaction – always double-check the recipient address and amount.

8. Use multisig for large amounts.

Some advanced multi-currency wallets (such as Keystone, Trezor, Ledger) support multisignature wallets. This setup requires multiple devices to authorize transactions. It’s particularly useful for corporate custody or managing large investment portfolios.

9. Keep the physical device secure.

Store your wallet in a safe location, out of reach of unauthorized persons. Losing a device without the seed phrase isn’t fatal, but a PIN-protected wallet with live assets still presents a target. Avoid leaving it unattended in offices, hotels, cars, or any other vulnerable locations.

10. Test your recovery phrase.

It’s good practice to occasionally test your recovery phrase on a separate device – without transferring funds – just to verify it was recorded correctly. This becomes especially important if a lot of time has passed since the wallet was first set up.