Digitalization in banking has quickly become the most critical aspect of the ever-advancing digitalization in the banking industry. Digital banks across the globe have understood the apparent shift in consumer preferences for digital services.

Whether mobile payment options, online banking with specific product offerings, or services such as an account aggregator — more and more people are now choosing to bank digitally.

The largest neobanks that adapt to these changing consumer behaviors, including the demand for offshore bank accounts, will be viewed as innovative commercial institutions that ensure their customers receive essential services anywhere, at any given time.

Revolut [ create an account ]

Revolut is one of the top digital banks that offers instant access to your money, a built-in currency exchange, and a prepaid card. Revolut was founded in 2015 by Nikolay Storonsky and Vlad Yatsenko. It’s based in London, England, and has a valuation of $33 billion.

The company raised $916 million in its latest funding round at a valuation of $580 million. This most recent money will help Revolut expand into new markets like the U.S., Australia, Canada, Singapore, Hong Kong, Japan, and New Zealand. The company has 15 million customers across Europe, Asia, and Australia who use Revolut for everything from paying bills to sending money abroad to topping up your prepaid card when you’re traveling abroad.

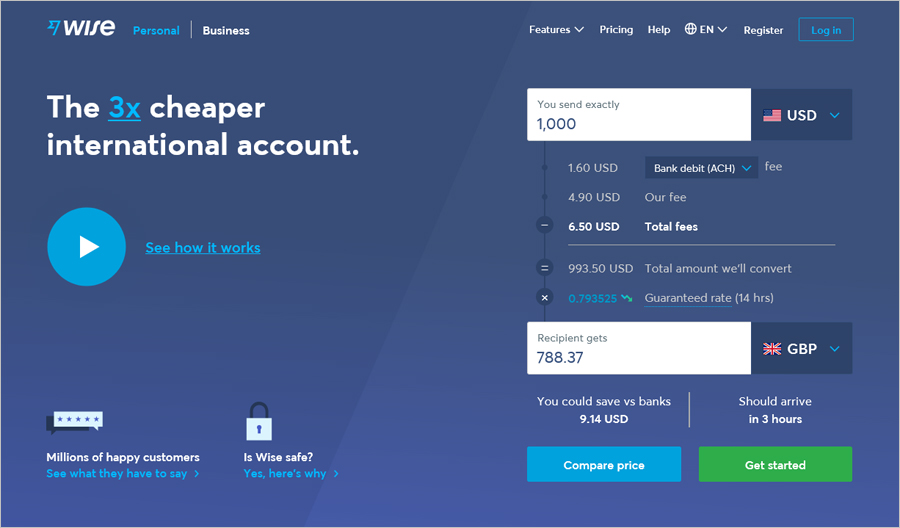

Wise [ create an account ]

Wise Bank is a financial services company providing top-notch personal banking and business banking services to customers across the globe. The bank was founded in 2011, and it’s headquartered in New York City. It has won several awards for its innovative approach to banking, including being named one of the top 100 most innovative companies globally by Forbes magazine.

The company has more than $5 billion in assets under management, and it recently raised $1 billion from investors, including Amazon founder Jeff Bezos. Wise is one of the biggest online banks that offers a range of products and services, including current accounts, savings accounts, and loans. The app allows you to manage your finances with ease and the customer service was excellent when we contacted them.

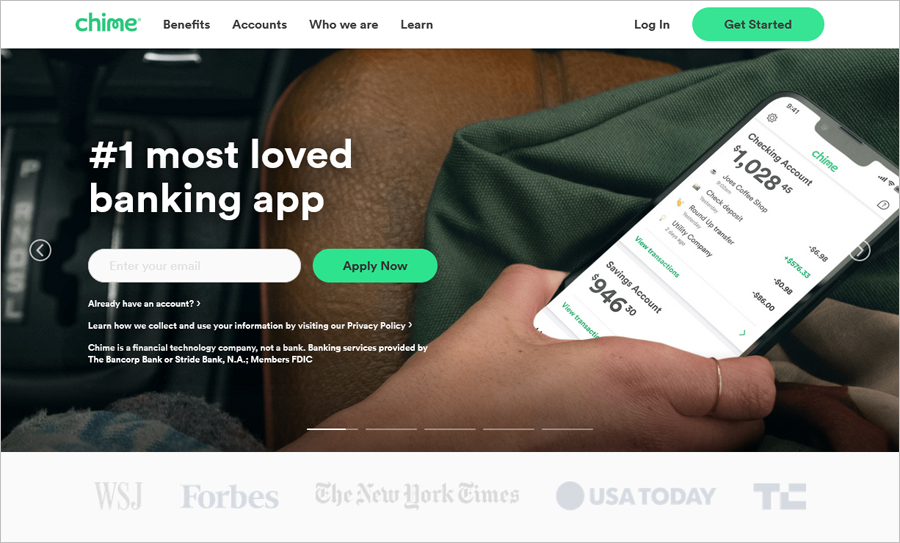

Chime [ create an account ]

Chime Bank is a digital-only bank founded in 2013 by Chris Britt, who had previously established the mortgage company, Fannie Mae. The company is based in San Francisco, CA, and has a valuation of $14.5 billion.

In September 2020, Chime raised $485 million at a valuation of $1.3 billion from investors, including JP Morgan Chase, Wells Fargo, and Google Capital. The company has 12 million customers and provides personal banking services such as checking accounts, savings accounts, credit cards, mortgages, and loans.

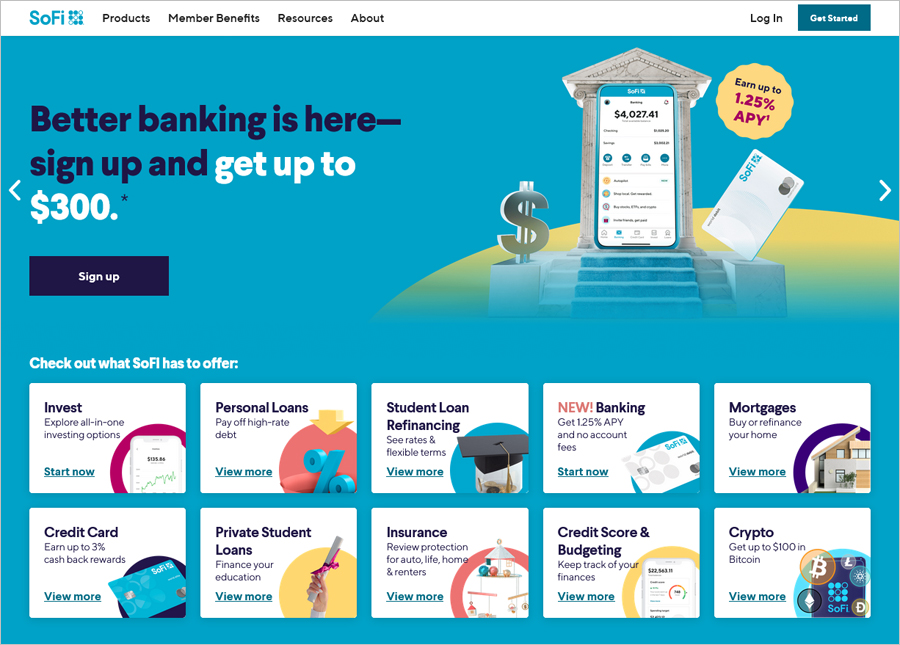

SoFi [ create an account ]

SoFi is a financial technology company headquartered in San Francisco, California. It was founded in 2011 by Mike Cagney and Anthony Noto. The company was valued at $9 billion after raising $3+ billion from investors.

SoFi offers personal financial products, including student loans, mortgages, and credit cards. It also provides business best digital banking platforms services, including accounts receivable financing, invoice factoring, accounts payable financing, and equipment financing for small businesses.

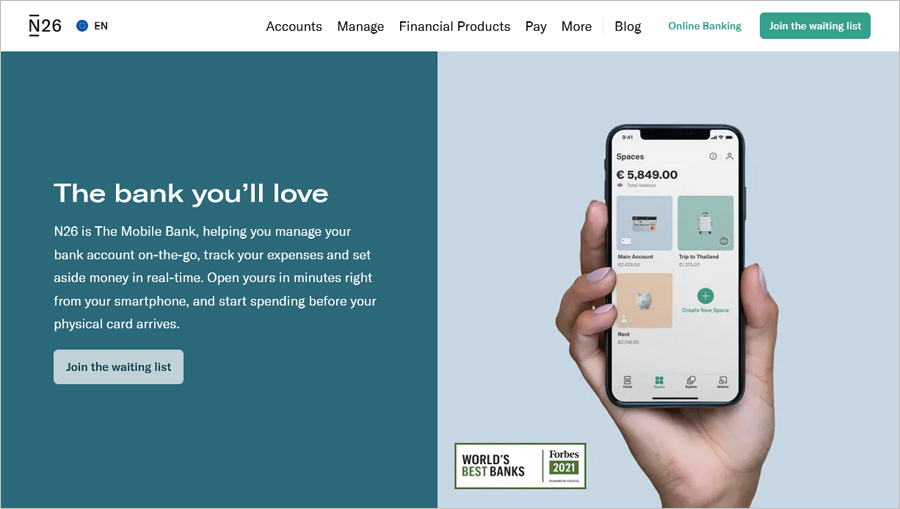

N26 [ create an account ]

N26 is a European bank that provides banking and financial services to individuals and businesses. It was founded in 2013 by Valentin Stalf and Maximilian Tayenthal and has since grown to over 7 million customers across Europe. The company operates in Germany, Austria, France, Spain, Italy, Greece, Poland, Belgium, and Ireland.

The company’s headquarters are located in Berlin. In December 2018, the company raised $819 million from investors, including Allianz X and Lufthansa Ventures, and other unnamed investors. N26 has been profitable since 2016 and plans to continue growing its customer base while also expanding its product offerings outside of just banking into insurance products and savings accounts.

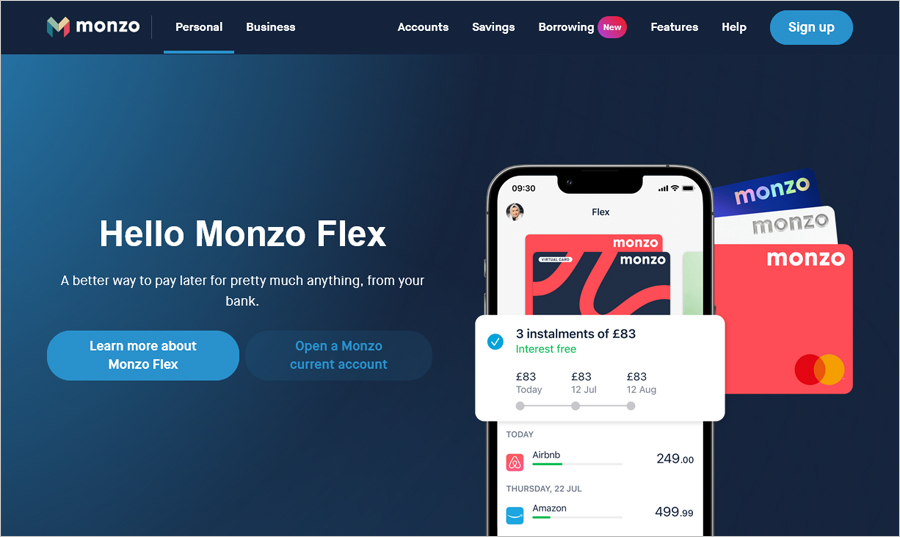

Monzo [ create an account ]

Monzo bank is a UK-based financial services company founded in 2015. The company has raised $595 million in venture capital funding and has a valuation of $1.6 billion. Since its inception, Monzo has been growing rapidly, with over 5 million customers and over 300,000 new signups every month.

Monzo offers a range of products to its customers, including a current account, savings account, and a credit card that can be used at any merchant through contactless technology. The bank also offers an app that allows users to manage their finances from their phones.

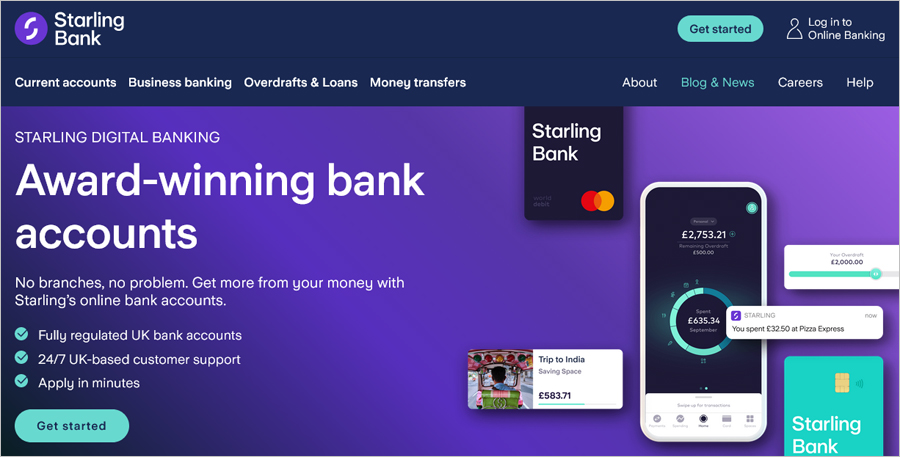

Starling Bank [ create an account ]

Starling Bank is a London-based financial technology company that provides retail and business customers with a range of banking services, including current accounts, savings accounts, loans and mortgages.

Starling Bank was founded in 2014 by Anne Boden and Peter Plumb. Based in London, it has grown rapidly since its inception, securing £20 million in Series A funding in 2015, followed by £100 million Series B funding in 2016 and $50 million Series C funding in 2018. It also raised $2.1 billion from investors at a $5.5 billion valuation earlier this year.

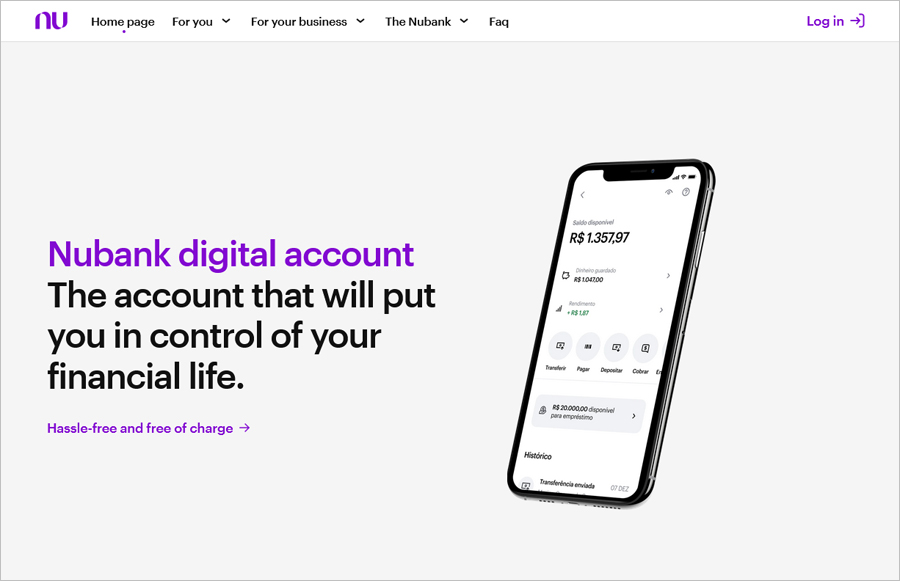

Nubank [ create an account ]

Nubank was founded in 2013 and is based in São Paulo, Brazil. It has raised $1.2 billion in funding over the past year, including $500 million from a recent Series funding round that led to a $4 billion valuation.

The bank has more than 5 million customers, and it plans to expand to 1 billion people by 2025. In addition to banking services, Nubank also offers investment tools, credit cards, insurance policies, and loans.

Varo Bank [ create an account ]

Varo is a bank founded in 2019. Based in San Francisco, California, Varo has raised $1 billion in funding and has a valuation of $2.5 billion. The company has over 1 million customers and plans to expand internationally soon.

C6 Bank [ create an account ]

C6 Bank is a Brazilian retail and business bank founded in 2018. Since its founding, it has raised $269 billion, with its latest round of funding at $252 million in December 2020.

It has 4 million customers and is currently valued at $2.1 billion. The company’s CEO is Marcelo Kalim.

Digital banking transformation will continue to grow in popularity, with more than half of global banks predicted to transition their business models from traditional branches to virtual ones by 2025.

As digital banking becomes more prevalent, customers will be able to manage various financial products – including mortgages and loans – on a single platform. As the number of global banks offering mobile banking application development increases, customers expect their preferred brands to provide even broader functionality and enhanced personalization options. Also you might be interested in TOP 8 best trading platfroms for crypto.